What Happened?

Shares of Opendoor Technologies OPEN +42.67% ▲ jumped 30% in pre-market trading Monday, as the housing platform company became the latest target in the meme stock frenzy. Since Tuesday, July 15, OPEN stock has skyrocketed over 188% by Friday’s market close. The company has caught the attention of retail traders, leading to a spike in trading over the past few days.

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks’ Smart Investor Picks, delivered to your inbox every week.

What Does Opendoor Technologies do?

Opendoor Technologies is a digital platform that streamlines the process of buying and selling homes. It allows homeowners to quickly sell their property by requesting an instant cash offer online. Meanwhile, buyers can explore and purchase homes directly through Opendoor’s website or app, often without needing a real estate agent.

What’s Happening with OPEN Stock?

Opendoor Technologies saw its stock soar from around $11 in July 2020 to over $30 by February 2021. However, by the end of 2022, shares had plunged to just $1.16 per share. The sharp decline came amid rising interest rates, which drove up borrowing costs and hurt the company’s core business.

Recently, Opendoor has captured the attention of retail investors over the past week, with its stock skyrocketing more than 180%. The rally was sparked by a bullish July 14 post on X from EMJ Capital’s Eric Jackson, who laid out a turnaround case for Opendoor and set a bold long-term price target of $82 per share.

Jackson also anticipates Opendoor will post its first positive EBITDA in August. He applauded the company’s shift in strategy, choosing to partner with real estate brokers rather than compete against them. Additionally, the company has also aggressively slashed costs and now faces limited competition.

Is OPEN Stock a Good Buy?

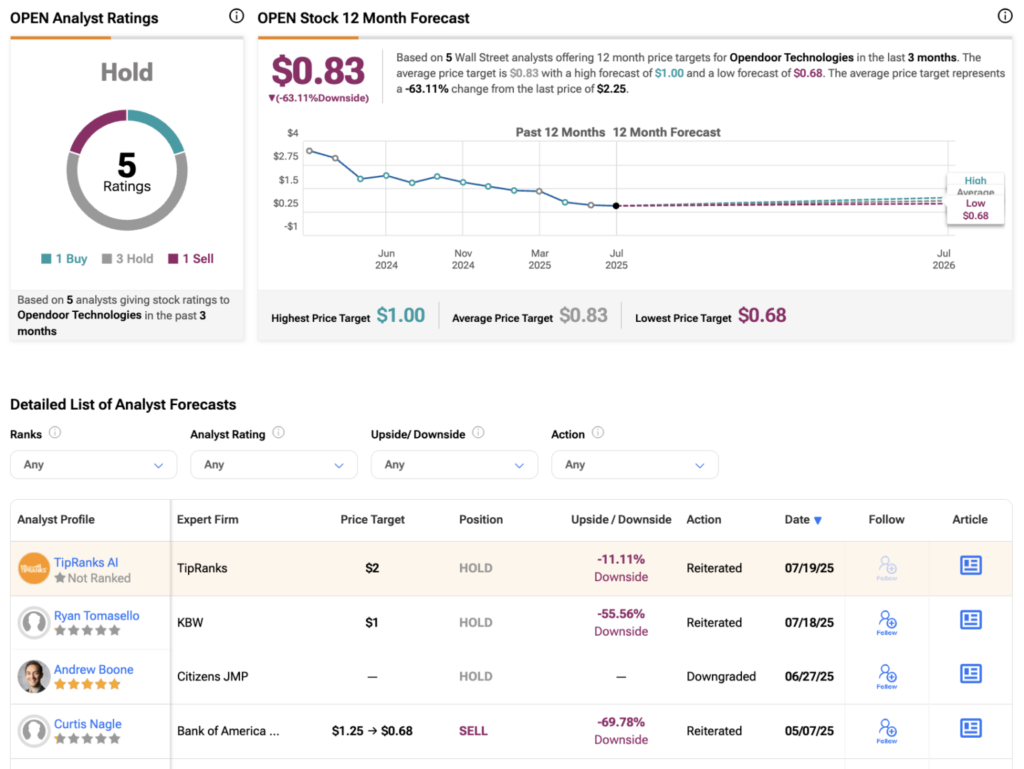

Turning to Wall Street, analysts have a Hold consensus rating on OPEN stock based on one Buy, three Holds, and one Sell assigned in the past three months. Furthermore, the average OPEN price target of $0.83 per share implies 63.1% downside risk.

Shares of technology real estate company Opendoor OPENjumped 80.1% in the afternoon session after a social media post from an influential investor predicting a strong turnaround. The stock remained a favorite among retail traders, with mentions soaring on platforms like Reddit’s WallStreetBets and X, turning it into a so-called “meme stock.” Investor Eric Jackson, known for a successful early call on Carvana, fueled the rally by suggesting a significant upside for Opendoor, citing cost reductions and improving margins. This enthusiasm led to a surge in trading volume and a classic “short squeeze,” where investors betting against the stock are forced to buy shares to cover their positions, further driving up the price.

What Is The Market Telling Us

Opendoor’s shares are extremely volatile and have had 82 moves greater than 5% over the last year. But moves this big are rare even for Opendoor and indicate this news significantly impacted the market’s perception of the business.

The previous big move we wrote about was 5 days ago when the stock gained 29.5% as the stock continued its upward momentum from the previous day’s session, which was sparked by news of activist investor interest.

Opendoor is up 153% since the beginning of the year, and at $4.01 per share, has set a new 52-week high. Investors who bought $1,000 worth of Opendoor’s shares 5 years ago would now be looking at an investment worth $334.73.